Learn All About The True Link Spending Monitor

Introduction

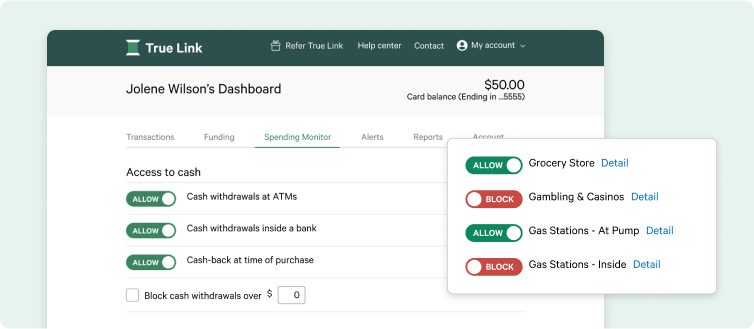

The Spending Monitor is at the core of how True Link helps families and professionals help protect the finances of the people they support — and it’s what makes the True Link Visa® Prepaid Card different from other prepaid, debit or credit cards. Every full-featured True Link Visa Card has access to the Spending Monitor that empowers the Card administrator (e.g. a family member managing a Visa card for a loved one or a professional using it to serve a client) with the ability to customize a number of important settings – like where the Visa card can be used to make purchases or if cash withdrawals should be blocked.

Typically, a person who takes on the role of Card administrator is already supporting someone in a caregiving capacity –perhaps they are helping a loved one navigate recovery from addiction, caring for a parent with dementia, raising a child with disabilities, or acting as a professional trustee or fiduciary. Card administrators have access and control over the Spending Monitor settings, but the person they’re caring for (we refer to them as the “cardholder” in this article) cannot adjust these settings. We designed True Link to serve the needs of both cardholders and administrators – one account, but two distinct experiences. While the cardholder can access basic information like the balance on the card or recent transactions, the Card administrator is the one with the ability to manage how and where the Visa card can be used.

We built the Spending Monitor to be flexible, so it’s easy to adapt to a cardholder’s changing needs. When you’re using the Spending Monitor for the first time, choose settings that align with what you believe will be most helpful. After a cardholder begins using the Visa card, it’s common for Card administrators to go back into the Spending Monitor to make changes. Adjusting settings as you go should be expected, and updates can be made at any time.

<h2 style="display: none;" >Key terms to know</h2>

[fs-toc-omit]Key Spending Monitor terms to know

Merchants

Each store, restaurant, and vendor is identified by a “Merchant Category Code” that is used by Visa to classify the type of services or goods being sold. While merchants select their own category based on their primary business, there are thousands of merchant codes with very specific classifications. For example, merchants selling food may classify themselves as “Eating Places, Restaurants,” “Fast Food Restaurants,” “Grocery Stores,” “Bakeries,” or “Convenience Stores and Specialty Markets. ”And while these codes are helpful for credit card companies, the categories could be confusing and overwhelming for someone trying to choose which merchants to allow or block for the person they care for.

Spending Categories

To help make these merchant codes easier to understand and use in everyday situations, True Link groups these codes into more meaningful categories. For example, in the Spending Monitor you’ll find a category labeled “Gambling and Casinos.” This Iabel includes several merchant codes related to gambling, including (but not limited to): Government-run Lotteries, Online Casinos, Online Horse and Dog Racing, and Casinos and Gambling establishments. So, if you choose to block purchases in this category, the Spending Monitor would also block transactions from a merchant with any of the codes in this category.

Allow/Block

In the Spending Monitor you’ll find toggles to “Allow” or “Block” each spending category. When a toggle is set to “Allow,” the Visa card can be used to make purchases at merchants in this category. When a toggle is set to “Block,” purchase attempts at merchants in this category will be declined and the Card administrator can opt-in to receive an alert (which can come from email, text1 or through a mobile app)with information about the blocked transaction. Alerts are a great way to stay confident that your Spending Monitor settings are working as intended, and having this real-time information can help you troubleshoot any issues or check in on the cardholder.

<h2 style="display: none;" >Spending Settings</h2>

[fs-toc-omit]How to Use the Spending Monitor

We suggest that administrators review the Spending Monitor before a True Link Visa Card is activated to confirm it is configured to meet a cardholder’s specific needs. Once you’ve made your initial selections, settings can be updated in real time, at any point in the future.

Spending Categories

We suggest you begin by reviewing the recommended spending categories we’ve included at the top of the Spending Monitor. Because we’re focused on helping people protect the finances of those they care for, we’ve been able to identify patterns of behavior and spending categories that could lead to financial missteps, high-risk behaviors, or financial exploitation. Not every category will apply to each cardholder’s situation and needs, but we’ve tailored our list to include the most commonly blocked categories and biggest areas for spending concerns. Plus, we’ve combined similar merchant types into categories so you don’t have to scroll through a list of thousands.

Think of these spending categories as your top-line protections. This is where you can block:

● Online and over-the-phone purchases;

● International transactions;

● Money transfers; and/or

● Purchases at merchants on True Link’s ScamWatch™ list (our database of merchants flagged as potentially predatory or fraudulent)

Other commonly blocked categories include: Subscriptions, Bars & Liquor Stores, Gambling & Casinos, and Travel & Transportation.

While we’ve grouped merchant codes into spending categories to help administrators block several types of purchases, we know there are instances where it helps to be more granular. For example, maybe you want to prevent a cardholder from making "online and phone purchases" to help protect against scams. Blocking this category can help prevent spending on telemarketer donations, TV infomercials, or purchases made by mail. But, since many utility companies prefer payments online or over the phone, you may want to set up an exception to allow "utility bill payments online or by phone", so the cardholder can pay for these important bills.

Keep in mind that the spending categories are used to block or allow purchases at the merchant level. Visa – and therefore True Link – does not receive itemized data from merchants, so the Spending Monitor isn’t able to block specific items at a merchant from being purchased. If a merchant is included in an allowed spending category, the cardholder will be able to purchase anything from that store.

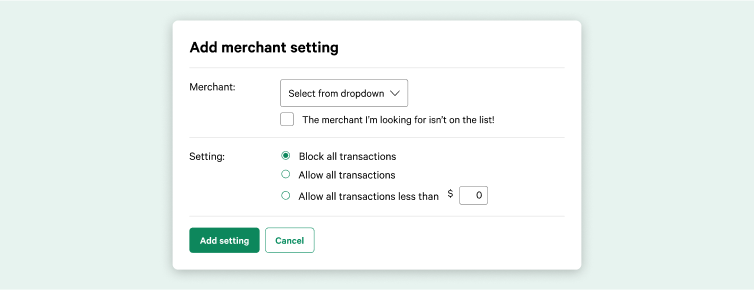

Merchant Exceptions

Merchant settings give you the ability to dive into the details and create spending rules for individual merchants. In this section of the Spending Monitor, you can block or allow purchases at specific merchants and set rules for maximum spending limits per transaction for those merchants. Note that you do not have to specifically allow a merchant for purchases to be successful. For example, if “Grocery Stores” is allowed as a spending category, purchases at any merchant categorized as a Grocery Store will be allowed.

Merchant settings are most commonly used when an exception is necessary. For example, if “Restaurants” are blocked as a spending category but you want the cardholder to be able to order pizza once a week, you can set an exception to allow purchases from their local pizza shop and limit the transaction amount to the cost of one medium pie, $20 for example. Or maybe you blocked “online and phone purchases” above, but want the cardholder to be able to pay for their Netflix account or buy food for their pets on Chewy.com. Both of these could be added as merchant exceptions with their own purchase spending limit set.

Merchant exceptions can also be helpful when a purchase needs to be made that is outside of what would be allowed by typical Spending Monitor settings – like when a broken appliance needs to be replaced or a plane ticket needs to be purchased to attend to a family emergency. By adding the merchant as an exception and setting a higher purchase spending limit (in this case, something like $500), the cardholder will be able to make this important purchase. Once the purchase has been made, the administrator can remove the exception.

Keep in mind that merchant settings always supersede Spending Category and Spending Limit rules. When determining if a purchase should be approved, True Link’s system will look to the Merchant Settings for final guidance on what to allow or block. Because merchant settings override spending limit settings, it's important to set a purchase limit for each merchant exception you add, even if you want this to be the same as the Spending Limit you set for all other purchases. If there is not a purchase limit listed next to the merchant, then the system assumes that it should not limit how much is purchased at that specific merchant.

<h3 style="display: none;" >Spending Limits</h3>

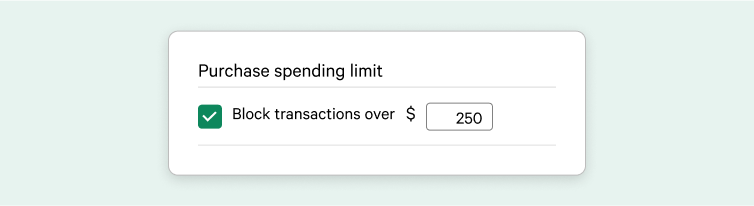

[fs-toc-omit]Purchase Spending Limits

This section of the Spending Monitor settings can be helpful for budgeting and preventing big purchases. Spending limits can be set for all transactions and/or at the merchant level. For example, an administrator could set transaction limits of $25 for any time the Visa card is used AND set a merchant-specific limit for the local pharmacy to help a cardholder cover their monthly $50 copay.

If you are supporting a cardholder on their path to recovery, your Spending Monitor will have additional spending limit settings, such as setting a daily spending limit as well as spending curfews that prevent the Visa card from being used during certain hours where triggers could be more prevalent.

In addition to these Spending Monitor settings, how you choose to fund the Visa card can also help with budgeting. When administrators set up recurring weekly transfers, cardholders know how much they have available to spend each week and can make spending decisions accordingly.

[fs-toc-omit]Cash Access

If you want to limit a cardholder’s access to cash, this is an important section of the Spending Monitor settings.

Here you can allow or block:

● Cash withdrawals at ATMs;

● Cash withdrawals from a teller inside of a bank; and/or

● Cash back with a purchase.

If you want to allow a cardholder to access cash, but only up to a specific amount, you can set a transaction limit specifically for each cash withdrawal.

Temporary Overrides

When you or your cardholder ends up in an unexpected situation, the Temporary Overrides section of the Spending Monitor can come in handy. Here you can block or allow spending categories or specific merchants.

Administrators often also find these settings useful when the cardholder is actively trying to make an approved purchase at a merchant, but the transaction won’t go through. This can happen when merchants have unexpected categorizations. Our spending categories are based on Visa’s merchant codes which are determined by a merchant’s primary business, but if a merchant has multiple lines of business, the way that a cardholder interacts with that merchant may not align with their merchant code.

Thrift stores are a common example of this category mismatch, because many of them are run by charitable organizations. This means, if you Block the spending category “Charitable Donations” in the Spending Monitor, the cardholder won’t be able to make purchases at a thrift store. Instead of allowing the specific merchant via Merchant Exceptions, the administrator can Temporarily Allow all purchases while the cardholder is in the store, and then disable it as soon as the transaction goes through. The cardholder is able to buy what they need at the moment, and the Card administrator can be confident that their standard Spending Monitor settings have been reinstated.

You can also set up a Temporary Block to block all transaction attempts. This can be helpful in situations where a cardholder’s behavior has you concerned about risky spending decisions or their personal safety. Like with the Temporary Allow all spending setting, once this short-term Block is disabled, the Spending Monitor will return to its previous settings.

<h2 style="display: none;" >Help protecting benefits</h2>

[fs-toc-omit]Protecting public benefits eligibility for Special Needs Trust (SNT) beneficiaries

Many SNT trustees and trust administrators use the True Link Protection Visa Prepaid Card to disburse trust funds to their beneficiaries. When the Visa card is used in a manner that aligns with the guidelines in the Social Security Administration’s2 POMS (Program and Operations Manual System), it can help the SNT beneficiary spend trust funds without jeopardizing their benefits. You can learn more about tips to set up the Visa card to align with POMS guidelines here, but it starts with setting specific rules within the Spending Monitor.

Using the Spending Categories and Cash Access settings above, the True Link Protection Visa Prepaid Card can be customized for usage in accordance with specific trust requirements, such as preventing the cardholder from purchasing food or shelter. This helps give the cardholder independence to spend on their own, but helps the trustee feel more confident that they won’t make purchases that could jeopardize their benefits.

[fs-toc-omit]Additional Use Cases

We know every cardholder’s situation is unique, which is why we created a Spending Monitor that can meet the varying needs of tens of thousands of cardholders nationwide. If you’re looking for inspiration on how to set up the Spending Monitor to work effectively for you and the person you support, here are some more examples of how administrators like you leverage these settings:

How the Spending Monitor can be used with an aging parent:

● Arthur and the Peet’s Coffee prepaid Visa card

● Ruth and the telemarketer's charitable solicitations

● A Romance Scam Takes Advantage of Joel

● Lorraine and the In-Home Caregiver

● Bobby and the Expensive Scams

Using the Spending Monitor for people with disabilities:

● David Learns Good Spending Habits

● Brad Struggles to Help Niece as her Trustee

● Paula worries less about her son’s spending

● Trust Officer Desiree Prepares to be Audited

● Tim Helps his Sister as Trustee

The Spending Monitor is what separates the True Link Visa Card from other prepaid cards. When customized to fit the needs of the person you care for, it can help protect their finances while giving them more independence in their daily life. Have more questions about how to choose or change your Spending Monitor settings? Contact our Customer Support team.

1Text notifications may be subject to additional charges/fees from your carrier.

2 Not associated with or endorsed by the Social Security Administration or any other government agency

The True Link Visa Prepaid Card is issued by Sunrise Banks N.A., St. Paul, MN 55103,Member FDIC, pursuant to a license from Visa U.S.A. Inc. This Card can be used everywhere Visa debit cards are accepted. Use of this card constitutes acceptance of the terms and conditions stated in the Cardholder Agreement.

.jpg)